nebraska inheritance tax calculator

The Nebraska State Tax Calculator NES Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223. Anything above 15000 in value is subject to a 13.

The Estate Tax Exemption Is Adjusted For Inflation Every Year

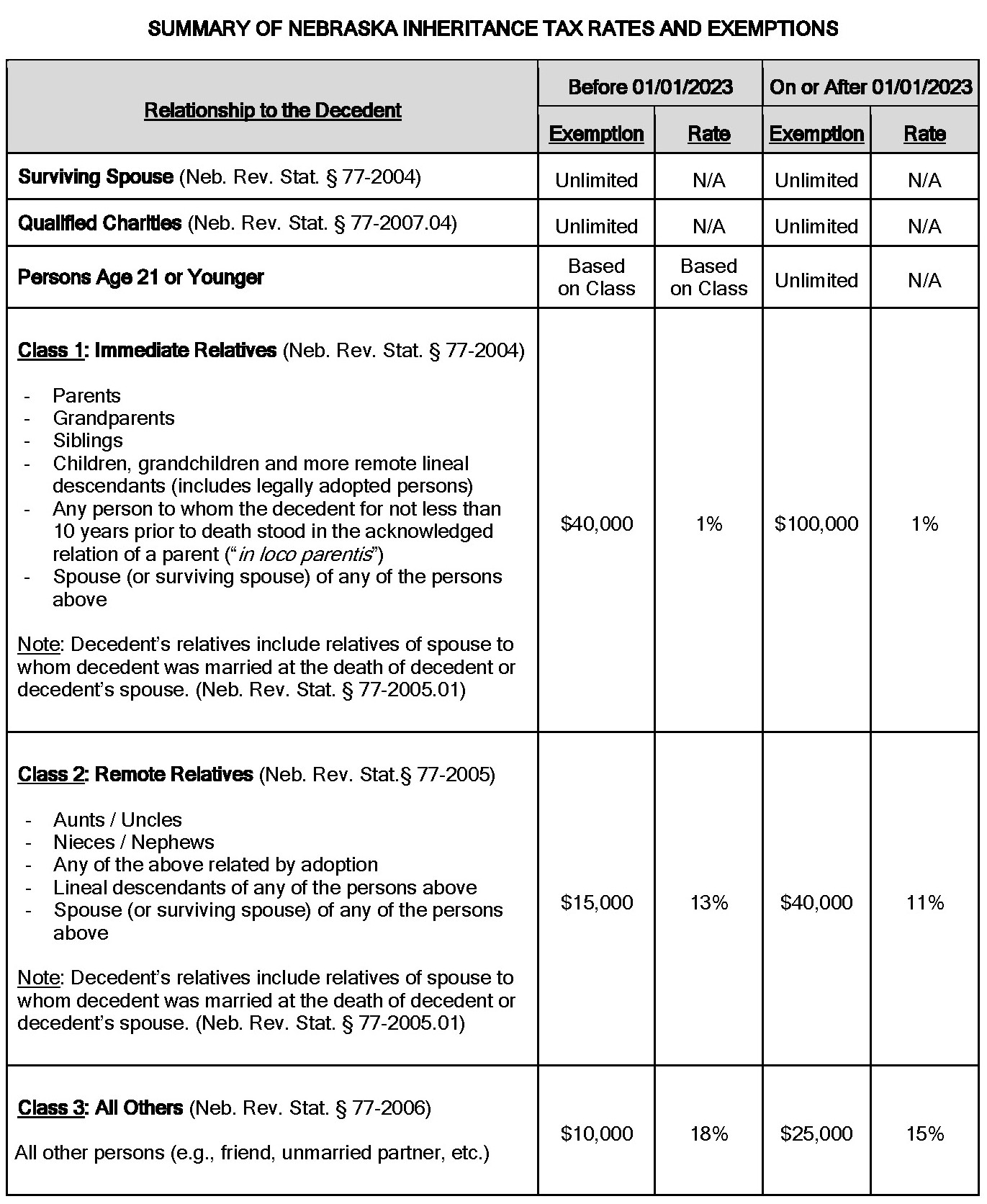

Currently the first 15000 of the inheritance is not taxed.

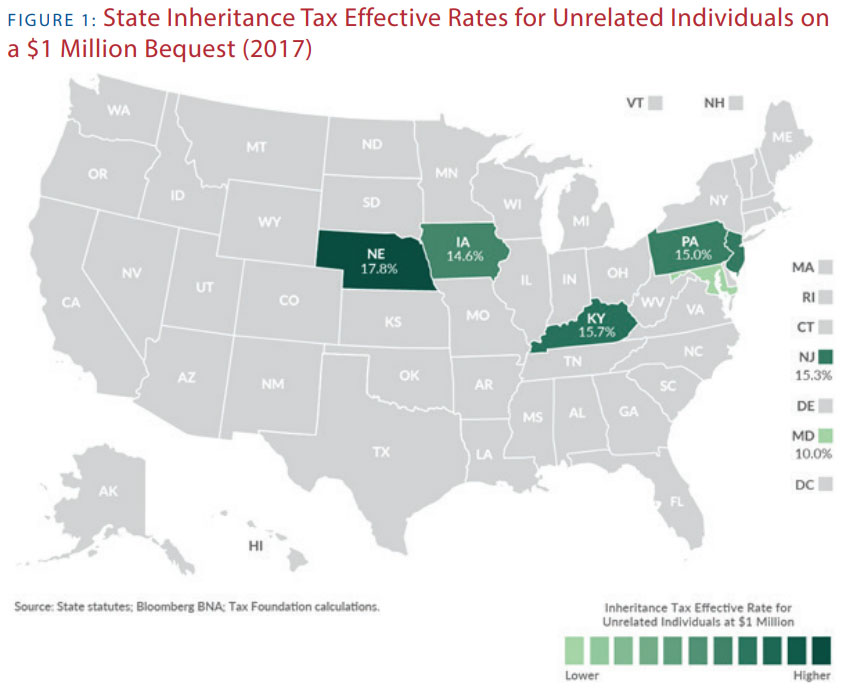

. Map showing state inheritance tax rates. The burden of paying Nebraskas inheritance tax ultimately falls upon those who inherit the property not the estate. The estate tax is paid based on the.

In short if a resident of Nebraska dies and their property goes to their spouse no inheritance tax is due. Enter your annual income in Nebraska. Anything above 15000 in value is subject to a 13 inheritance tax.

The major difference between estate tax and inheritance tax is who pays the tax. Press Calculate to see your Nebraska tax and take home breakdown including Federal Tax deductions How to use the advanced Nebraska tax. The fair market value is the present value as.

Nebraska income tax brackets range from 246 to 684Nebraska uses a progressive tax rate system meaning. Beneficiaries are responsible for paying the inheritance tax on the assets they inherit. An inheritance tax is usually paid by a person inheriting an estate.

Capital Gains Tax Rate Calculator. Generally inheritance taxes are paid to the county or counties where the inherited property is located. Nebraska inheritance tax is computed on the fair market value of annuities life estates terms for years remainders and reversionary interests.

The major difference between estate tax and inheritance tax is who pays. Not all states do. In fact most states choose not to impose a tax on time-of-death transfers.

How is this changed by LB310. Beneficiaries inheriting property pay an inheritance tax over. The inheritance tax is levied on money already passed from an estate to a persons heirs.

Suite 200 Lincoln NE. Generally property may not be inherited until the inheritance tax is paid. The Nebraska inheritance tax applies to all property including life insurance proceeds paid to the estate which passes by will or intestacy.

402 475-7091 Toll Free 800 927-0117 Fax 402 475-7098. The first thing you need to figure out is your Nebraska income tax rate. If it goes to their parents grandparents siblings children or a lineal.

Nebraska has an inheritance tax. Nebraska income tax brackets range from 246 to 684nebraska uses a progressive tax rate system meaning that higher levels of income are taxed at higher rates. Of Nebraskas neighbors Colorado Wyoming South Dakota and.

Nebraska State Bar Association 635 S. Use this link to find the County Court in Sarpy County or any Nebraska county.

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Estate Inheritance Tax Threshold Rates Calculating How Much You Owe

What Is Inheritance Tax Who Pays An Inheritance Tax Estate Planning

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Inheritance Laws What You Should Know Smartasset

Does Nebraska Have An Inheritance Tax Hightower Reff Law

Free Estate Size Worksheet And Tax Calculator Married Free To Print Save Download

Is There An Inheritance Tax In Kansas Estate Planning Attorneys In Missouri And Kansas

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Death And Taxes Nebraska S Inheritance Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

Inheritance Tax 2022 Casaplorer

What Is The Estate Tax In The United States The Ascent By The Motley Fool

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Inheritance Tax A Brief Overview And Tax Planning Opportunities Mcgrath North A Client Driven Law Firm Supporting Business In Nebraska The Midwest And Across The Country

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nebraska Inheritance Tax Worksheet Form Fill Out Sign Online Dochub

What Is The Difference Between An Inheritance Tax And An Estate Tax